Paytm Money Demat Account Refer and Earn, Paytm Money Referral Code

Just like Dhan, Upstox, Angel One, 5 Paisa, Paytm Money is great way to start your investing journey.

Introduction- Paytm Money Demat Account Refer and Earn

In the modern era of technology-driven financial services, Paytm Money has emerged as a prominent player in the Indian investment landscape.

It’s a subsidiary of the renowned mobile commerce platform Paytm.

Paytm Money has revolutionized the way Indians invest and manage their wealth.

This article explores the intricate workings, features, and impact of Paytm Money.

The Genesis of Paytm Money

Paytm Money was launched in September 2018 with the aim of democratizing wealth management

It provides easy access to investment opportunities for millions of Indians.

Paytm Money leverages cutting-edge technology to empower both seasoned investors and beginners alike.

The platform’s integration with the Paytm app ensures a hassle-free experience for users, making it convenient to manage investments on the go.

Features of Paytm Money Demat Account Refer and Earn

Mutual Fund Investments

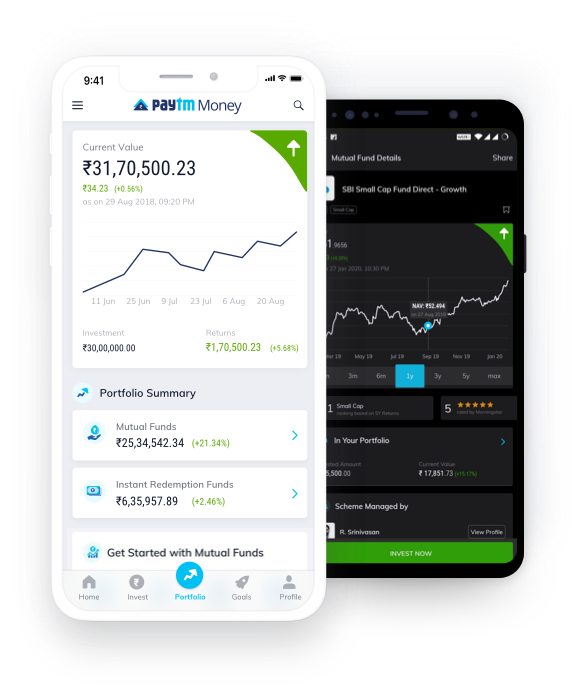

Paytm Money provides a comprehensive platform for investing in mutual funds.

Users can browse through a wide array of mutual fund schemes, compare their performances, and make informed investment decisions.

The platform offers both regular and direct plans, allowing investors to choose the plan that best suits their preferences.

Equity Investments

Paytm Money introduced equity investments, enabling users to directly invest in stocks.

The platform’s user-friendly interface simplifies stock trading and provides real-time market data.

It also provides research reports, and historical performance charts to aid investors in making informed choices.

Digital Gold

Paytm Money facilitates investments in digital gold, allowing users to buy, sell, and store gold digitally.

This feature taps into the cultural significance of gold in India.

Paytm Money provides a secure and convenient avenue for individuals to invest in this precious metal.

Initial Public Offerings (IPOs)

Paytm Money has ventured into the realm of IPO investments, providing users the opportunity to participate in the primary market.

This move further diversifies the platform’s offerings and caters to investors seeking exposure to new companies entering the market.

NPS (National Pension System)

Paytm Money expanded its portfolio to include the National Pension System.

It is enabling users to plan for their retirement through this government-regulated investment avenue.

Smart Investment Features

The platform offers various tools such as “Riskometer” and “Mutual Fund Screener”

This feature is to assist users in assessing their risk tolerance and identifying suitable mutual funds.

Additionally, “Auto Mode” allows investors to set automatic investments at regular intervals, promoting disciplined investing.

User Experience and Interface

Paytm Money prioritizes a seamless user experience, employing an intuitive interface.

It guides users through the investment process.

The platform provides detailed information about each investment option.

These options include historical performance, fund manager details, expense ratios, and risk factors.

This transparency empowers users to make well-informed decisions aligned with their financial goals.

Security and Compliance

Security is a paramount concern in the digital finance space.

Paytm Money places a strong emphasis on safeguarding user data and investments.

The platform employs robust encryption and authentication measures to ensure the privacy and security of user information.

Furthermore, Paytm Money operates in compliance with the regulatory framework set by the SEBI

Advantages and Impact

Financial Inclusion

Paytm Money has played a pivotal role in promoting financial inclusion by providing access to investment opportunities to individuals across urban and rural India.

Its user-friendly interface and low investment thresholds cater to both experienced investors and novices, thus bridging the investment gap.

Cost-Effective

The platform’s direct plans offer lower expense ratios compared to regular plans, allowing investors to maximize their returns by minimizing costs.

Convenience

Paytm Money’s integration with the Paytm app makes it incredibly convenient for users to manage their investments

It is also convenient to track portfolio performance and execute transactions from their smartphones.

Educational Resources

Paytm Money offers educational resources, articles, and tutorials to enhance financial literacy among users, empowering them to make informed decisions independently.

Market Competition

The entry of Paytm Money into the investment landscape has spurred healthy competition, compelling traditional financial institutions to enhance their digital offerings and provide more value to investors.

Challenges and Future Prospects

While Paytm Money has enjoyed remarkable success, it is not without its challenges.

Regulatory changes, market volatility, and the need for continuous technological innovation are ongoing considerations.

However, the platform’s ability to adapt and evolve positions it well for the future.

Paytm Money’s potential growth lies in expanding its product offerings, refining its robo-advisory services, and further strengthening its user engagement strategies.

Conclusion

Paytm Money has ushered in a new era of digital wealth management in India, enabling individuals from all walks of life to invest and grow their wealth effortlessly.

By leveraging technology, transparency, and financial education, Paytm Money has empowered users to take control of their financial futures.

As the platform continues to evolve and innovate, it is poised to remain a key player in India’s investment landscape, fostering a culture of informed and empowered investors.

Frequently Asked Questions About Paytm Money Demat Account Refer and Earn

1. How do I refer customers to Paytm Money?

Login to the Dashboard, get a referral link and share it within your network.

2. What can I do in case of an issue?

We assure grievance support for all our Referral Partners in case of any issue.

Please reach out to your relationship manager or partnerships@paytmmoney.com in case of any support required.

3. Is there an age limit to the Paytm Money Partner Program?

Yes, you must be 18 years or older