Deciml App Referral Code: Deciml is an investment app that automatically rounds up your online transactions and instantly invests the spare change.

App in India is an investment app that enables users to automatically and instantly invest the spare change from their online transactions.

It also makes it easy and exciting for young Indians to begin their journeys of investing in India.

Also Read: INDstocks Referral Code: DEE60MQPIND | Earn Rs. 500 Per Referral

Deciml App Referral Code App Download

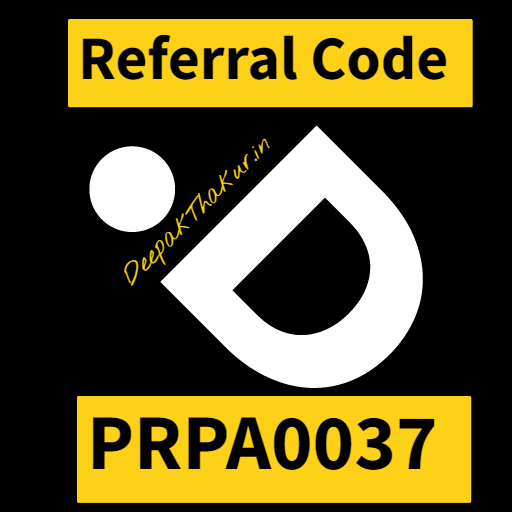

| Deciml App Referral Code | PRPA0037 |

|---|---|

| Referral Link | Download |

| Sign Up | FREE |

| Set-Up | Auto-Pay |

| Referral Bonus | Rs. 50 |

Deciml App Referral Code PRPA0037

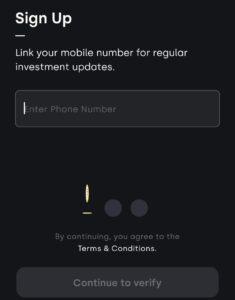

Deciml App Sign Up Process

1. Download the app from given link.

2. Open the app and enter the mobile number.

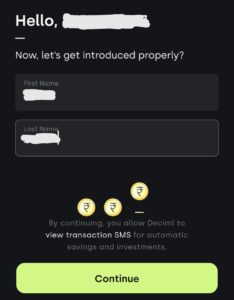

3. After verifying the mobile number, enter first name, last name.

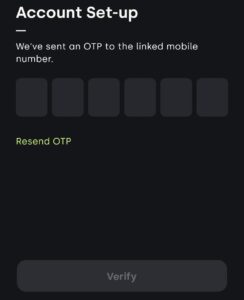

4. Now you need to set up your account. To start the same, re-enter your mobile number and give the OTP received.

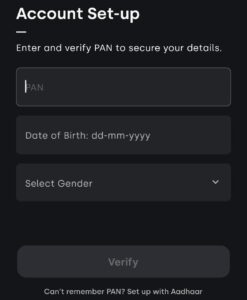

5. Enter Pan card number, date of birth and gender.

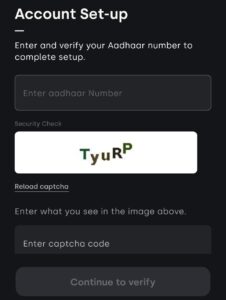

6. In next step, Verify your Aadhaar number.

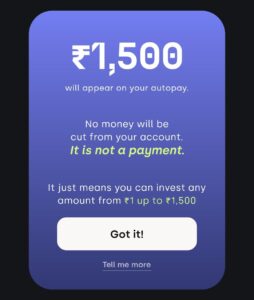

7. At the end, You will receive a pop up on your UPI app. Allow the mandate so that your investment will be deducted automatically.

Read More: Teji Mandi Referral Code: Earn Rs. 300 Per Referral

How Deciml App Works

How? By round-up investing! Deciml is a smart investrnent app in India that works on the basis of round-up investing.

Round-up investing is the automatic rounding up of your online transactions to the next 10 (or multiple of 10 — whichever you choose), and the subsequent investment of the digital spare change.

Say, for example, you ordered momos for dinner and paid Rs. 395 for it via your UPI app.

The Deciml app picks up this spent amount from transaction SMS you receive from your bank

For the same due permission is taken in advance from the user.

App automatically rounds it up to the next 10 — which is Rs. 400 in this case, and instantly makes an investment of the digital spare change of Rs. 5 on your behalf.

Once you have set up the Deciml account, a small investment is automatically made after every small and big online transaction of yours.

In order to set up the Deciml app, users simply have to complete their KYC (Know Your Customer) process as mandated by the RBI and set up an AutoPay.

Investment through Deciml App

Besides rounding up, users of the Deciml app can also choose to continue their smart investments via Deciml Daily Deposits or make lump-sum investments.

Deciml Daily Deposits allows users to make an automatic investment of as little as 10 on a daily basis,

It keeps their small investments consistent — even on the days that don’t spend.

Lump-sum investments, on the other hand, empower young users to invest an amount as little as {100 whenever they want to.

This way users get into the habit of investing and making the most of any extra amounts they may have.

Deciml App KYC

At Deciml app in India, we have quickened both of these steps so that the whole set-up process takes no more than a couple of minutes

users can start their journey of smart investment in India immediately!

For KYC — users simply have to enter and verify their name, number and PAN.

It is also at this point that Deciml requests user permission to view transaction SMS only.

No offer SMS is read by the Deciml app, and no data is shared.

How to do Auto Set Up in Deciml App

The AutoPay step has been simplified by enabling users to set it up quickly via their preferred UPI apps-

Users can simply enter their UPI ID, accept the AutoPay request on their UPI apps.

The set-up process for the Deciml app is as easy and quick.

On completion of the set-up process for the Deciml app, users’ round-up investment limits are set to a default

You can edit and increase to a multiple of 10 whenever they want.

UNLOCKING THE POWER OF COMPOUNDING

There are three important things to remember if you are investing in instruments that offer a compounding interest structure of returns.

Track Your Expenses

The more you invest, the more you can earn on your investments with compound interests.

And how can you maximize your investment amounts?

By making sure you have enough money to put into your savings and redirect toward your investments. So, don’t be careless with how you spend your hard-

earned money.

Stay Consistently Invested

Be disciplined with your investing practices.

Whatever amount you might allocate to monthly investments, be sure to diligently invest that amount.

There’s no room for that super expensive bag or a brand new watch if it is eating into your investments.

Secondly, be patient with investments that are compounding in nature.

If you are looking for quick returns, compounding isn’t for you!

But, if you can see the value in making small investments over a period of time diligently.

You will be sure to reap the benefits in the long term.

Start Early

If we’ve said it once, we’ve said it a thousand times (and we will still say it again!) — START EARLY!

As soon as you have an income, you need to get on the compounding bandwagon.

Identify investment opportunities that align with your personal financial goals, and start making good use of your savings now.

On that note, we will say this — compounding is only a secret because so few of us know how it works, or how it benefits us.

But the cat’s out of the bag now.

Now you know all about compounding and its (not so) secret power.

it’s time to put that knowledge to use and start reaping the benefits of compounding now!