How to Apply Online for Swiggy HDFC Credit Card, Swiggy HDFC Credit Card Review

In this post, we are going to discuss how to “How to Apply Online for Swiggy HDFC Credit Card“.

You will get to know all the steps of applying Swiggy HDFC Credit Card.

So read all the steps and apply accordingly.

Read More: Shop, Dine and More with Axis Myzone Credit Card. Apply Now

Brief Introduction of Swiggy HDFC Credit Card

The Swiggy credit card offers some great cashback all around.

We can spend up to Rs 15000 on Swiggy to get Rs 1500 cashback. If you are a foodie who likes ordering in or dining out, then this is a good option.

Free IDFC FIRST Credit Card + Free Gift Voucher worth Rs 500

The Swiggy HDFC Bank credit card misses out on some key features like airport lounge access, fuel surcharge waiver.

How to Apply Online for Swiggy HDFC Credit Card

Also Read:

Kiwi Credit Card Referral Code | Get Rs. 250 Free

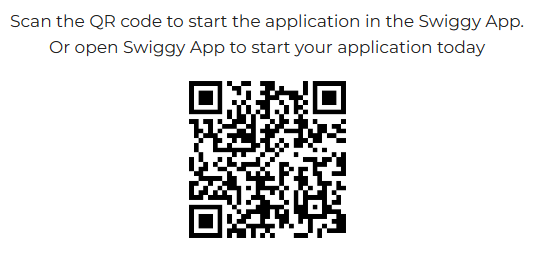

1. Open the Swiggy app on your phone.

2. You will see a pop up appearing on home page of swiggy app just like showing in below picture.

3. By Clicking on Apply Now, it will take you to a new page. Click on Apply Now.

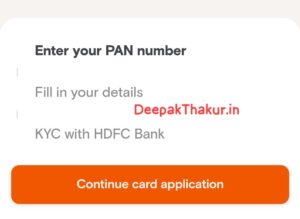

4. Fill some basic details by clicking on “Continue card application.”

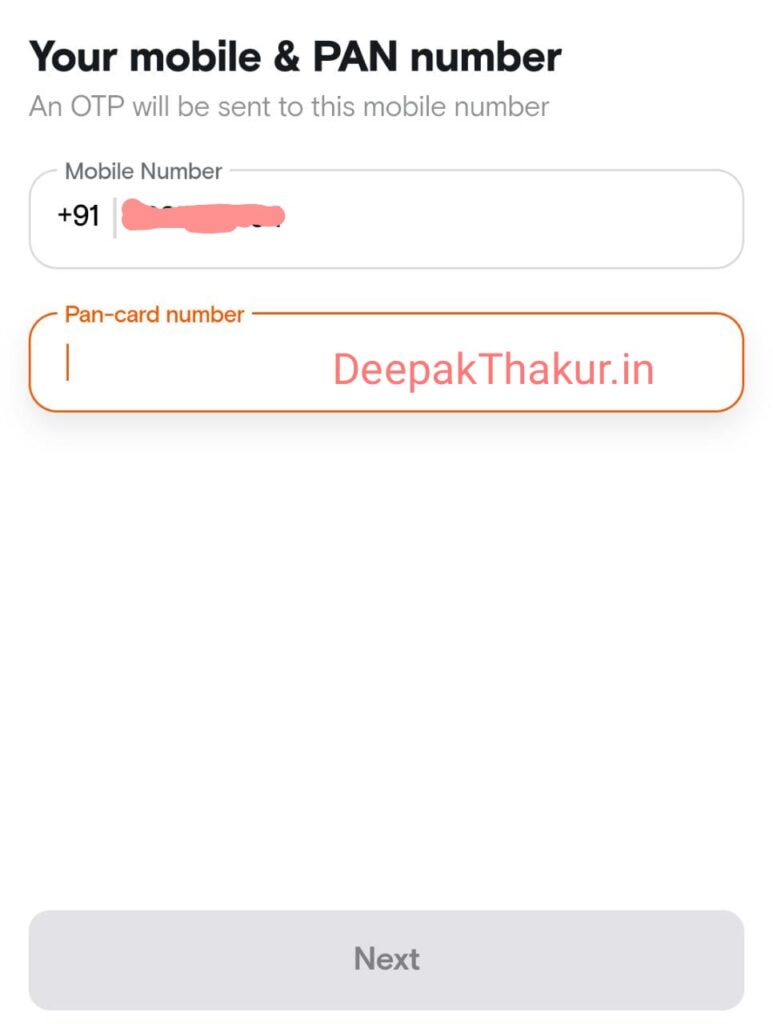

5. Enter your mobile and PAN card number.

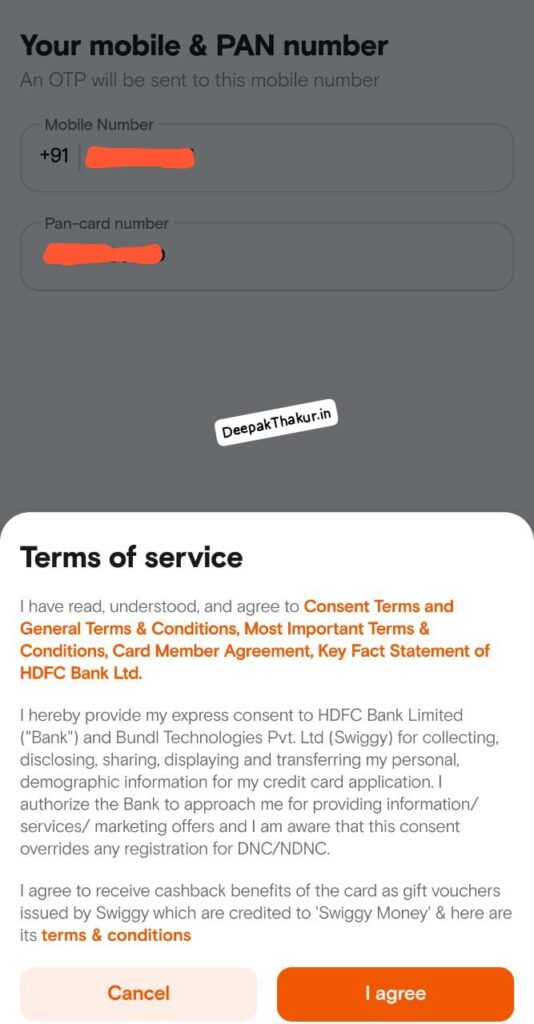

6. Now Click on Agree Button so that application will proceed further.

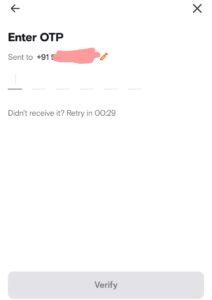

7. Enter the OTP received on your mobile number.

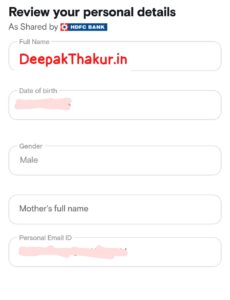

8. Now you need to fill up some details with HDFC bank as swiggy credit card is given with partnership with HDFC Bank.

9. Enter Full name, Date of Birth, Gender, Mother’s full name and your personal email id.

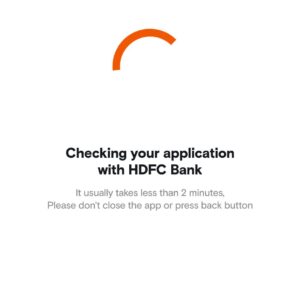

10. Wait for few second as application is going through some internal checks.

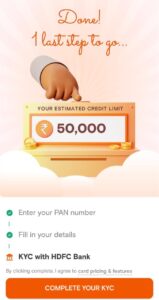

11. If your card is approved, then it will show with your credit card limit.

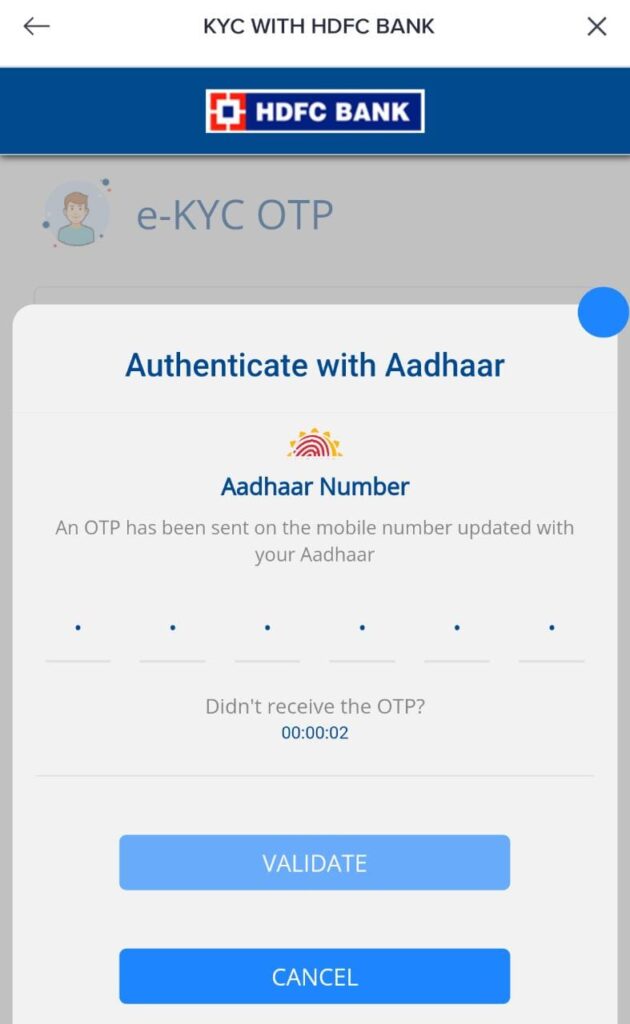

12.Congratulations, you have got your Swiggy HDFC Credit Card. Now authenticate yourself with Aadhaar.

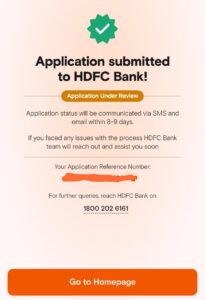

13. Now, you will get Video KYC option. Complete the Video KYC and your application will be submitted with HDFC Bank for review.

You will also get the card reference number.

Features of Swiggy HDFC Credit Card

- 10% Cashback on Swiggy application (Food ordering, Instamart, Dineout & Genie). For more details Click here

- 5% Cashback on online spends across top brands. For list of eligible MCC Click here

- 1% Cashback on other categories. For list of exclusions & capping Click here

- Complimentary Swiggy One Membership for 3 months on card activation as per latest RBI guidelines

In accordance with RBI guidelines, cardholder can activate the card by following one or more below mentioned ways:

- Making a transaction using the Credit Card,

- To use the card via OTP or IVR, setting PIN for the card, and enabling card controls such as online transactions, enabling international transactions etc.

Swiggy HDFC Bank Credit Card Eligibility

Eligibility:

For Salaried Indian national

Age: Min 21 years & Max 60 Years

Net Monthly Income > ₹25,000

For Self Employed Indian national

Age: Min 21 years & Max 65 Years

ITR > Rs 6 Lakhs per annum

Welcome Benefit

Get complimentary Swiggy one Membership for 3 months on card activation as per latest RBI guidelines.

In accordance with RBI guidelines, cardholder can activate the card by following one or more below mentioned ways:

- Making a transaction using the Credit Card,

- To use the card via OTP or IVR, setting PIN for the card, and enabling card controls such as online transactions, enabling international transactions etc.

Have a Look:

- Kiwi Credit Card Referral Code | Get Rs. 250 Free

- Teji Mandi vs SmallCase: Which One to Choose?

- Quick Ride Referral Code “NTTA48” | Get First Ride Free

- BharatNXT App Review |Interest Free |Rewards and Cashback

- Millionaire Track vs Bizgurukul | Choose Which One is Best

Fees & Charges of Swiggy HDFC Credit Card

Joining Fee / Renewal Membership Fee – ₹500 /- + Applicable Charges

Spend ₹2,00,000 or more in a year, before your Credit Card renewal date and get your renewal fee waived off.

Exclusions for Spends of Rs. 2,00,000 and above for eligibility of renewal year fee waiver are as follows:

- Cash on Call

- Balance Transfer

- Cash Withdrawal

Renewal Offer

Exclusions for Spends of Rs. 2,00,000 and above for eligibility of renewal year fee waiver are as follows:

- Cash on Call

- Balance Transfer

- Cash Withdrawal

Swiggy Money Redemption & Validity

Swiggy Money Redemption:

Cashback earned on Swiggy HDFC Bank Credit Card is redeemable as Swiggy Money only on Swiggy application on following Swiggy platforms –

- Food ordering

- Instamart

- Dineout

- Genie

You can utilize Swiggy Money selecting Swiggy Money under the profile section payment method within the Swiggy application.

Swiggy Money Cashback with the closest expiry date will be used up first so that you can get the maximum benefit.

Cashback is not applicable on transactions less than Rs. 100

Frequently asked questions

If you have an HDFC Bank credit card already

No worries at all! Rest assured that you can absolutely proceed with your application for this card.

How and when do I get cashback

Cashback gets credited to Swiggy money, within 10 days of your monthly statement date and can be accessed via the ‘My Accounts’ on the Swiggy App.

Where all can I use this cashback.

The cashback can be used to pay for your various food, grocery, dineout & genie orders on Swiggy. You can see your Swiggy money balance automatically while paying for an order or by visiting the Swiggy money section on Swiggy app.

What categories of Swiggy will I get the 10% cashback on?

You will get 10% cashback on these offerings by Swiggy: Food, Instamart, Dineout & Genie. The latest list of categories that the card supports cashback for will be updated by Swiggy.

What type of online spends will I get 5% cashback on?

You will get 5% cashback on spends on the following:

(i) E-commerce

(ii) Electronics

(iii) Entertainment

(iv) Hobbies

(v) Local cabs

(vi) Department stores

(vii) Home decor

(viii) Medical

(ix) Personal care

(x) Discount stores.

You can reach out to HDFC Bank at 1860 202 6161 for the most up to date list of exclusions.