Slice Mini Borrow Review: Try slice for smooth payments and instant credit!

Use Slice Invite/Referral Code GET150 and get ₹ 150 cashback on your first mini or borrow transaction.

You can also try Kiwi Axis Bank Rupay Lifetime Free Credit Card which gives you instant Credit Limit.

Also Read:

EarnKaro App Real or Fake | Review | Income Proof: Slice Mini Borrow Review | No interest If Paid in One Month! Teji Mandi Review: Subsidiary of Motilal Oswal Financial Services: Slice Mini Borrow Review | No interest If Paid in One Month! Best Edtech Platforms for Earning Money, You Must Know: Slice Mini Borrow Review | No interest If Paid in One Month!Slice Borrow Review

Slice borrow allows you to seamlessly borrow money in just a few clicks.

You can repay across 12 months or repay early which can help you save interest.

You will get one month interest free period.

It is same as before, 30-day interest-free period like others.

You can say that “Slice Pay Later” is now “Slice Borrow” now.

Is Slice Borrow Safe to Use (Slice Mini Borrow Review)

Slice Borrow is completely safe to use as many people are already using this feature of Slice

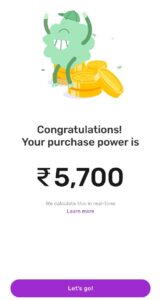

In simple words, you will get a credit limit according to your profile.

If needed, you can withdraw this amount to your bank account instantly.

Best part is that for one month It’s interest free.

It means you don’t have to pay any interest if you are repaying the taken amount in 01 month.

Slice Borrow Late Fee Charges

The below charges are applicable:

Late interest: it’s charged on the total principal outstanding from the due date.

Late Fee: it’s charged on the total principal outstanding amount on a daily basis.

| Principal Outstanding Amount | Per day charges |

| Rs.0 to Rs.500 | Rs.0 |

| Rs.501 to Rs.2,000 | Rs.15 |

| Rs.2,001 to Rs.10,000 | Rs.40 |

| Rs.10,001 to Rs.25,000 | Rs.100 |

| More than Rs.25,000 | Rs. 150 |

Note: The late fee will be capped at 30% of the total outstanding principal amount or ₹ 3000/- (whichever is lower).

Reason for Slice Borrow not Working

You might be facing this issue for two reasons:

- You may have delayed your repayments.

- We might have detected suspicious activity on your account.

If you are not facing any of the above-mentioned reasons, please reach out to our customer support for more help.

Slice Mini Review

Currently, most of the people are getting waitlist for slice mini but if you have access to slice mini then you can use it without any worries.

Slice mini is a prepaid account where you can add and withdraw money.

You can add money using your UPI or debit card. It is made for everyone.

Also, you can activate your mini account without going through any credit assessment.

Slice mini–Debit Transactions Limits (Slice Mini Borrow Review)

1.For full KYC users, the cumulative transactions are limited to ₹ 2,00,000 in a day, ₹ 10,00,000 in a month and ₹ 30,00,000 in a year.

2.Your limit is ₹ 2,00,000 and remains same across the three mentioned time interval (daily, monthly and annually).

3.For peer-to-peer transfers, the daily limit is ₹ 10,000 per transaction.

Please reach out to our customer support for more information on the limits.

How to Set up Slice mini–UPI Mandate- (Slice Mini Borrow Review)

Mandate is a feature uses for making recurring or periodic payments.

With UPI mandate, users can enable recurring payments for mobile bills, electricity bills, EMI payments, entertainment/OTT subscriptions, insurance, and mutual funds, among others.

Please enter your slice mini UPI ID on supported websites/merchants to set up a mini UPI mandate.

You can then approve the mandate request by entering your slice mini UPI PIN.