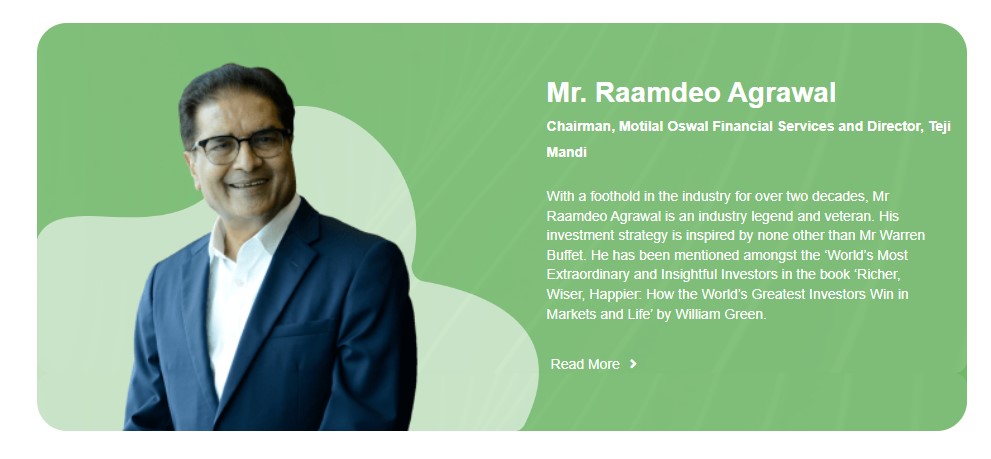

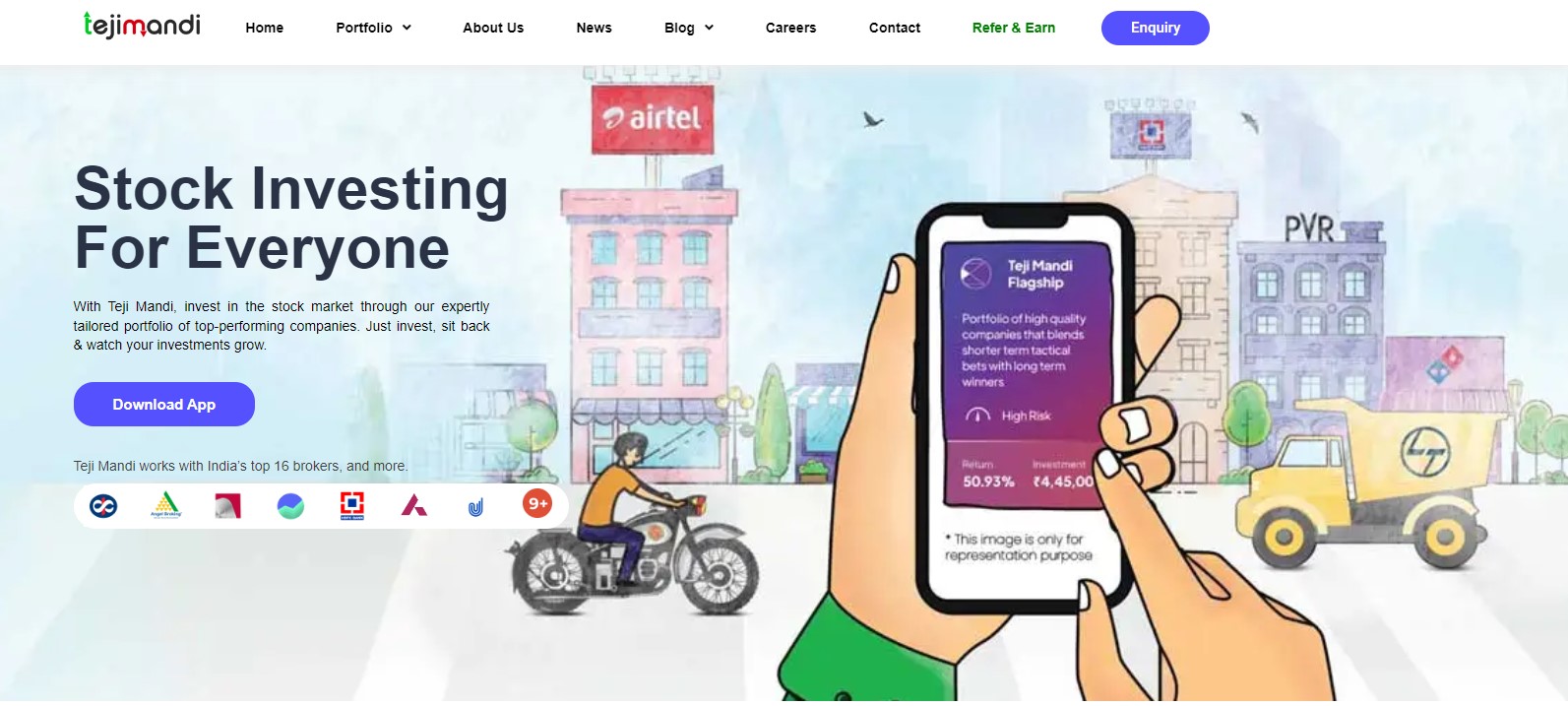

Teji Mandi Review: Teji Mandi, a SEBI registered subsidiary of Motilal Oswal Financial Services, is an enterprise built upon the amalgamation of finance and technology.

Teji Mandi Referral Code is iB6Bitqx. Read more about it. Click here

Website simplifes stock market investing for retail investors by supporting them via advisory services through an app.

It offers stock portfolios and share timely rebalance updates about when to buy or sell specific stocks.

Dhan App Referral Code: UNCHE93590 | Get 20% of Brokerage: Teji Mandi Review: Subsidiary of Motilal Oswal Financial ServicesTeji Mandi Referral Code: iB6Bitqx

| App/Website Name | Teji Mandi |

| Teji Mandi APK Download | Click Here To Download |

| Teji Mandi Referral Code | iB6Bitqx |

| Teji Mandi Referral Bonus | Rs. 300 Instant Cashback |

How much is the Teji Mandi subscription fee?

(Review) Teji Mandi offers two subscription plans for each portfolio:

Subscription plans for Teji Mandi Flagship portfolio:

6 months – ₹ 894 ( ₹ 149 per month)

12 months – ₹ 1,188 ( ₹ 99 per month)

Subscription plans for Teji Mandi Multiplier portfolio:

3 months – ₹ 1,497 ( ₹ 499 per month)

6 months – ₹ 2,394 ( ₹ 399 per month)

The renewal amount is not auto-debited from your account. However, we send you a reminder via e-mail and SMS 7 days before your subscription expires.

How much do you need to invest?

The minimum investment on your end is purposely low at INR 19-25k, depending on the value of the 15-20 stocks in our portfolio.

Since we cannot buy partial stocks in India, this is the minimum amount you need to have a balanced and diversified portfolio.

This amount may vary by a few rupees based on the current stock price.

When to invest in the Stock market?

Teji Mandi advises you that you should not try to time the market.

It offers a portfolio of stocks from a short to long-term perspective.

Therefore, entry price and target price will not be important.

You should buy the stocks at the current market price and rebalance the portfolio when the notification is sent.

How is Teji Mandi different from other advisories? – Review

With over 5,000+ stocks listed on the NSE/BSE, stock market investing can be complicated.

Investors are bombarded by stock tips, news, and pieces of advice.

It cut through the noise and simplify stock market investing for you and help you build a strong long-term portfolio.

Teji Mandi Stock Recommendations (Review)

Teji Mandi is a dedicated and diversified portfolio of 15-20 premium equity stocks.

It does not provide any individual or stock-specific advisory because having too much exposure to a few stocks, or a specific industry can adversely affect your returns due to market downside and increased volatility.

Therefore, we prefer investors to invest in at least 15 stocks of diversified portfolios.

Teji Mandi guaranteed returns?

As per the past result and data, there is no doubt that equities generate better returns than any other asset class over the long term.

As equity markets are subject to market risks with scope for both loss and profits, investment returns vary due to changing dynamics and external market conditions.

Teji Mandi believes in managing investors’ capital risk over guaranteeing returns in figures.

Also, as per SEBI, we can’t assure any promises on the returns. We aim to partner with you to make you a better investor.

4 thoughts on “Teji Mandi Review: Subsidiary of Motilal Oswal Financial Services”